COVID-19 – Canadian Tax and Business News, Release #10

Our COVID-19 Canadian Tax and Business News updates are our way of informing our clients, friends and business associates with recent information that may help businesses and individuals while coping with the outcomes from the COVID-19 pandemic.

Our goal is to monitor the news and release relevant information as it becomes available.

“I am a firm believer in the people. If given the truth, they can be depended upon to meet any national crisis. The great point is to bring them the real facts.” – Abraham Lincoln

Bill C-14 – COVID-19 Emergency Response Act, No. 2

On April 11, 2020, Canada enacted COVID-19 Emergency Response Act, No. 2. The Bill contained the long-awaited legislation that brings the Canada Emergency Wage Subsidy (CEWS) into law. The CEWS is 75% of remuneration paid and is intended to help businesses keep individuals on payroll during this economic downturn. The subsidy will be backdated to March 15, 2020. The program would be in place for a 12-week period from March 15, 2020 to June 6, 2020. The legislation provides that the government has the ability to extend this program to September 30, 2020. No announcement has been made at this time on an extension. It should be noted that the legislation allows the government to communicate to the public in any manner they consider appropriate to the parties that apply for the CEWS.

Is Your Business Eligible?

The legislation defines an “eligible entity” as a taxable corporation, partnership, sole proprietorship, not-for-profit and registered charity.

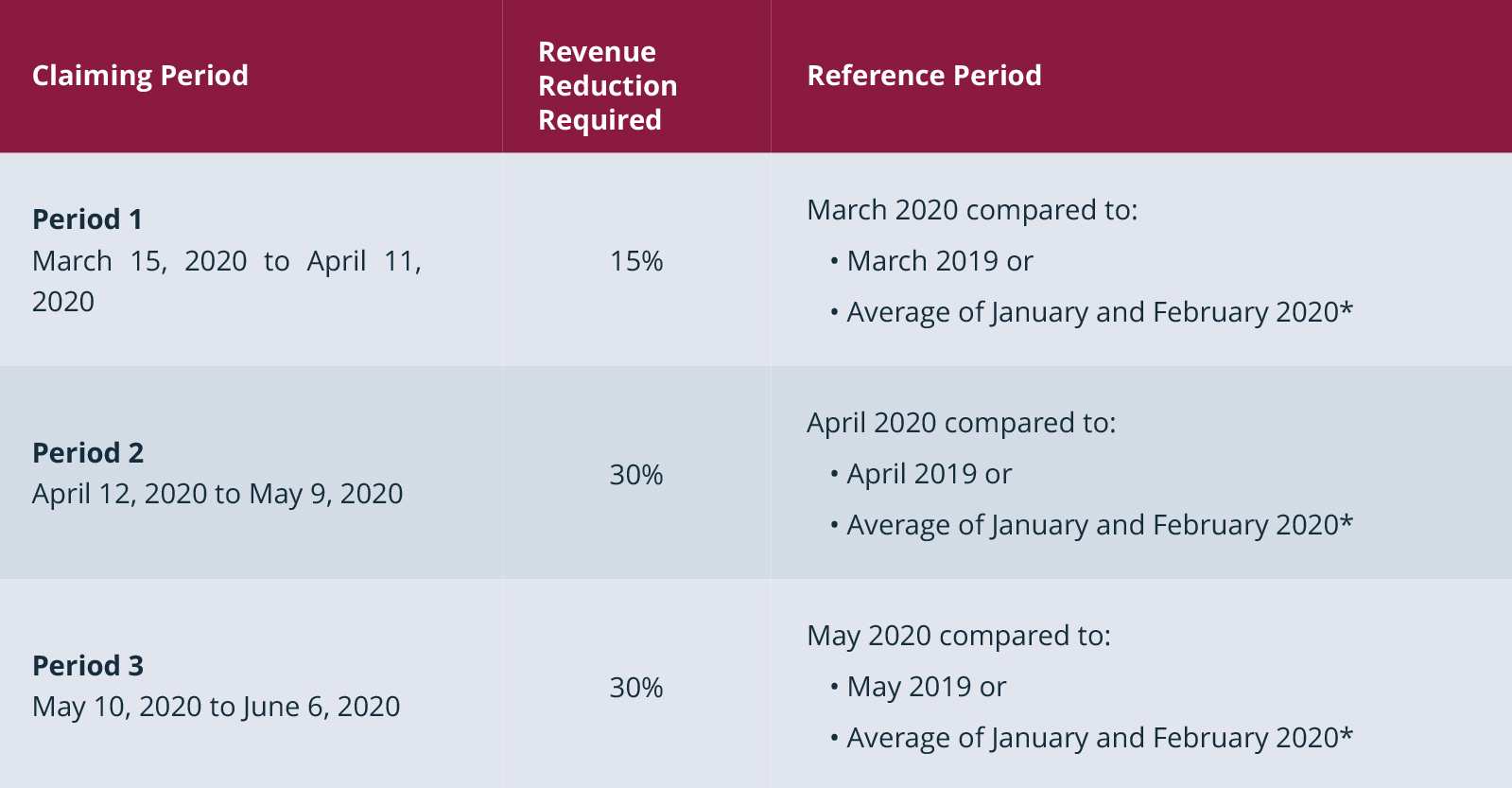

To qualify for the subsidy, the business must have seen a decline in revenue of at least 15% in March 2020 and 30% in April and May 2020 compared to the same time in the prior year or the average revenues in January and February of 2020. Employers need to indicate which benchmark is being used when they apply, and they will be required to use the same approach for the duration of the program. Furthermore, if an employer qualifies for a specific period, they will automatically qualify for the next period of the program. For example, an employer with a revenue drop of more than 15% in March would automatically qualify for April.

Revenue for this eligibility test is defined as cash inflows or receivables from the provision of services or sale of goods in the ordinary course of business carried on in Canada. Revenue would be calculated using either the cash method or accrual method but not a combination of both. Once a method is picked, it must be used for the duration of the program. Revenue of the business excludes “extraordinary items” and revenue from a related business (includes related sole proprietorships and partnerships). No definition of extraordinary items was included in the legislation. Businesses with the majority of their revenues outside of Canada would not qualify.

For corporate groups, there is a special rule in the legislation that allows “affiliated groups” to elect to compute revenue on a consolidated basis. This is beneficial as it allows entities earning all their revenue from non-arm’s length sources within an affiliated group to determine their decline in revenue, for purposes of meeting the eligibility test, based on the decline of the non-arm’s length parties’ revenues. This will specifically assist affiliated groups that have an entity with employees on payroll but only earns revenues from non-arm’s length corporations. Prior to the legislation, these entities would not have been eligible.

For the revenue comparison, the following periods will apply:

*Only applies if elected to use this benchmark throughout the program.

How Much Can Your Business Get?

The subsidy amount has not changed as originally announced by the Prime Minister. It is equal to 75% of remuneration paid up to $58,700 of salary per employee which roughly works out to $847 per week on an annual basis. There is no cap per employer which is welcoming, and the subsidy is simply capped based on the number of employees per business. Since the program is available for 12 weeks, the maximum eligible employers can receive per employee is $10,164 ($847* 12 weeks). There is no indication at this time if the program will be extended beyond 12 weeks however the legislation allows for extension to September 30, 2020.

Eligible remuneration for the purposes of the subsidy calculation is defined in the legislation and includes salary, wages and taxable benefits but excludes stock options, severance, personal use of corporate auto benefits. The subsidy for an employee for a given week is the greater of:

i. 75% of the wage paid up to $847 per week; and

ii. The lesser of:

a. Weekly wage paid up to $847 per week; and

b. 75% of the employee’s “baseline remuneration”.

Baseline remuneration is defined as the average weekly remuneration paid from January 1, 2020 to March 15, 2020 excluding any period of seven or more consecutive days for which the employee was not remunerated.

Given the mechanics of the calculation, there is potential for employers to fully recover the 75% paid without paying the other 25% where wages are reduced from pre-crisis levels. The government however is asking that all employers top up the other 25% of employee wages to bring them back up to their baseline remuneration.

The subsidy calculation in the legislation also includes the Employer Paid CPP and EI Refund Program details. Employers that qualify for the CEWS can receive a full refund of the employer paid CPP and EI contributions paid on wages eligible for the CEWS. To be eligible, the employee must not perform any work for the employer throughout the entire week being claimed. Therefore, it is not available for employees that are on leave with pay for only a portion of the week. This refund program is in addition to the $847 weekly maximum benefit and there is no limit on the refund amount. Employers must still remit the CPP and EI and will claim the refund as part of the CEWS application if applicable. There was no specific exclusion in the legislation for non-arm’s length employees so their employer paid premiums would also be eligible for refund provided the individual otherwise qualifies for the CEWS. This is discussed further below.

Which Employees Are Eligible?

Eligible employees include existing and new employees hired. However, eligible employees will be limited to employees that have not been without remuneration for more than 14 consecutive days in the eligibility period. As a result, the subsidy only extends to employees that have generally continued to have been paid since March 15, 2020 or will be rehired and paid during any of the eligibility periods.

Furthermore, for employees that are participating in the Work-sharing EI program, the subsidy amount is reduced by the EI amounts received by employees. Employers will have to obtain information from their employees as to how much they have received. Also, no subsidy is available for an employee that is receiving the Canada Emergency Response Benefit (CERB). The government is considering introducing a process to allow individuals on CERB to get rehired so their employees can claim the subsidy. This would require the employee to repay the CERB amount received in the subsidy period.

Non-Arm’s Length Employees

For non-arm’s length employees, such as relatives employed in the businesses, the subsidy amount is limited to 75% of their “baseline remuneration”. Therefore, if they were not on payroll from January 1, 2020 to March 15, 2020, no subsidy would be available to any amounts paid to them after March 15, 2020. If they were on payroll during that period, the mechanics of the formula prevent artificial increases to non-arm’s length salary after March 15, 2020 to get a higher or maximum subsidy.

How Do You Get the Subsidy?

The Canada Revenue Agency (CRA) will be administering this benefit and eligible businesses will receive refunds from the CRA. Applications will open online through the CRA website. Eligible employers will need to apply every month during March, April and May if they qualify. For the month of March, businesses will be able to apply in April retroactively and get the subsidy rebate. Finance expects subsidy amounts will be available in the next two to four weeks, but no definitive timeline or application date was announced. We will keep you posted once the application link goes live.

Anti-avoidance Rules and Penalties

For employees that are employed by more than one entity in a related corporate group, the legislation contains an anti-avoidance rule that limits the maximum subsidy and deems the employee to only have one employer for purposes of the CEWS.

There are also anti-avoidance rules to target revenue manipulation that would entitle employers to the subsidy. These rules are put into place to ensure businesses do not take advantage when they otherwise would not qualify. There is a 25% penalty for employers who manipulate their revenues.

A 50% gross negligence penalty can also be applied for false statements or gross negligence. Furthermore, Minister Morneau stated penalties as much as 200% could apply and five years imprisonment for tax fraud for businesses that abuse the program.

What If Your Business Doesn’t Qualify?

Employers who do not qualify for the CEWS can still apply for the previously announced wage subsidy of $25,000 which allows eligible employers to reduce payroll withholding taxes. The eligibility requirements of the previously announced subsidy are still applicable for employers looking to benefit from this. Please review our sixth publication in this series on our website for more details.

For businesses that qualify for both the previous wage subsidy and the CEWS announced, any benefit the business received from the old wage subsidy will reduce the amount available under the new benefit. For instance, businesses that will claim the old wage subsidy for the month of March when they remit in April will have to reduce their retroactive claim for March under the new wage subsidy when applications open later this month.

Books and Records

The government has stated the businesses have to maintain records to support their decline in revenues and the wages paid to employees. Since businesses must attest monthly that they qualify for the subsidy, penalties will likely be introduced as part of the draft legislation for non-compliance and fraudulent claims. This was emphasized by the Finance Minister when he stated that the money from this subsidy cannot be used for fraudulent purposes and must be used to pay employees salaries.

Resources

Bill C-14 COVID-19 Emergency Response Act, No. 2

Finance Release – Government Introduces COVID-19 Emergency Response Act, No. 2

As we all try to stay safe, we need to remind ourselves business will get back to normal but in the meantime let’s all do our part to get to normal as soon as we can. If you have any questions or require further information, don’t hesitate to reach out to us.